Investment Trends and Economic Outlook for 2025

The Indonesia India Business Forum (IIBF) recently held a high-impact session on Investment Trends and Economic Outlook for 2025 at the Fairmont Hotel in Jakarta. The event drew an engaged audience of Indonesian and Indian professionals, offering them a roadmap for navigating investment opportunities in the coming year. Industry experts Rahul Shegokar, CFA – Portfolio Counselor at Citibank International Personal Bank, and Sachin Gopalan, Founder & CEO of the Indonesia Economic Forum, headlined the event. Each speaker provided in-depth analysis and actionable insights, focusing on global and local economic landscapes.

Key Highlights from Rahul Shegokar’s Presentation

Rahul Shegokar’s presentation centered on the transformative role of artificial intelligence (AI) and technology in shaping global investment opportunities through 2025. He provided a comprehensive view of trends across equity, bond markets, and strategic investments, shedding light on how AI-driven innovations will drive significant shifts in key sectors.

1. AI as a Market Force

Shegokar emphasized AI’s rising influence in both public and private markets. He noted the record highs in tech stocks, driven by companies embedding AI into existing products for greater innovation and efficiency. Private market valuations also reflect this trend, with AI unicorns valued at $1.12 trillion, highlighting investors’ confidence in AI’s potential.

2. AI’s Application in Healthcare and Consumer Sectors

Healthcare and consumer-facing industries are poised to benefit immensely from AI innovations. AI-driven advancements in diagnostics, personalized treatment, and robotic surgeries have transformative potential in healthcare, while consumer-facing AI applications streamline experiences in sectors like e-commerce and media.

3. Global Economic Recovery

Signs of global recovery, with moderating inflation and supportive central banks, set a positive macroeconomic backdrop. Shegokar observed that this environment is conducive to sectoral growth, offering diverse investment opportunities.

4. Gold for Strategic Diversification

Shegokar recommended including a 5% allocation to gold as a hedge against market volatility, economic fluctuations, and inflation, thus enhancing portfolio stability.

5. Broader Equity Market Performance

With anticipated recovery in earnings across sectors, Shegokar forecasted broad-based equity market growth, especially for the S&P 500. This suggests opportunities across multiple sectors rather than concentration in a few.

6. Attractive Bond Yields

Shegokar pointed out that bond yields are expected to remain attractive, offering returns above inflation and helping investors hedge against rising volatility.

7. Investment in “Economic Security” Sectors

Shegokar underscored the importance of economic security investments in technology, cybersecurity, defense, and energy sectors, aligning with global shifts toward stability and resilience.

Key Highlights from Sachin Gopalan’s Presentation on Indonesia’s Economic Outlook for 2025

Sachin Gopalan presented a focused analysis on Indonesia’s economic landscape, examining the country’s growth potential and strategic initiatives under the new government. His insights covered Indonesia’s strengths, challenges, and pathways for sustainable growth.

1. Global Economic Context

Citing projections from the Asian Development Bank, Gopalan highlighted stable growth for ASEAN despite hurdles like China’s slowdown and geopolitical conflicts. Indonesia’s GDP growth for 2024 is forecasted at around 5%, positioning it mid-range among ASEAN countries.

2. Indonesia’s Consistent Growth Post-Pandemic

Indonesia’s post-pandemic GDP growth has remained steady at 5%, fueled by key sectors such as manufacturing, trade, and finance. Gopalan projected that this momentum will likely continue.

3. Rupiah Stability

The Indonesian Rupiah’s stability against the US dollar (15,100–15,750 in 2024) enhances investor confidence and supports economic consistency.

4. Ambitious Economic Goals

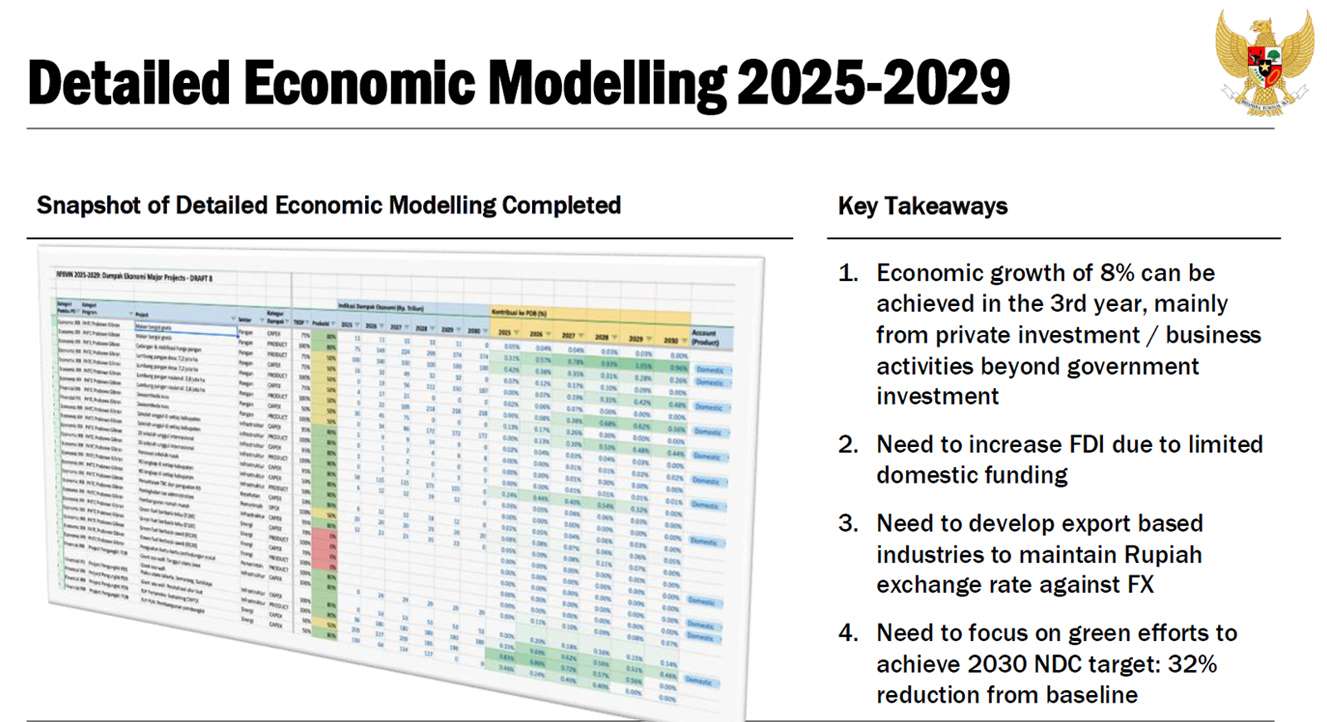

Gopalan outlined the incoming government’s goals for 8% GDP growth and the eradication of absolute poverty. Achieving these targets signals a robust commitment to economic expansion and poverty reduction.

5. Pathways to 8% Growth

- Private Investment and FDI: Increasing private and foreign investment is critical.

- Export Growth: Expanding export-driven industries strengthens the Rupiah and competitiveness.

- Sustainability: Emphasis on green growth aims to cut carbon emissions by 32% by 2030.

6. Strategic Growth Areas

- Multinational Corporations: Attracting global companies for increased FDI.

- Large Indonesian Corporations: Scaling operations for domestic growth.

- MSMEs: Enhancing micro, small, and medium enterprises’ contributions to GDP.

7. Projected Economic Impact

Achieving the ambitious 8% growth target could yield a GDP increase of Rp. 13,000 trillion (approx. $810 billion) over the next five years, signaling substantial economic potential for Indonesia.

The IIBF session offered valuable perspectives on the global and Indonesian economic outlook, underscoring the potential for diverse investment opportunities in the AI, healthcare, and economic security sectors. For Indonesia, strategic investment, policy-driven growth, and sustainable practices promise to enhance the nation’s economic resilience and prosperity through 2025 and beyond.

@IIBF.id

@IIBF.id

contact@iibf.id

contact@iibf.id

082210008272

082210008272